Condo Insurance in and around Redwood City

Welcome, condo unitowners of Redwood City

Condo insurance that helps you check all the boxes

- the Bay Area

There’s No Place Like Home

Are you investing in condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good time to get coverage for your unit with State Farm's Condo Unitowners Insurance.

Welcome, condo unitowners of Redwood City

Condo insurance that helps you check all the boxes

Protect Your Condo With Insurance From State Farm

Your home is more than just a roof and four walls. It's a refuge for you and your loved ones, full of your personal possessions with both sentimental and monetary value. It’s all the memories you’ve made there. Doing what you can to help keep it safe just makes sense! And one of the most reasonable things you can do is getting a Condominium Unitowners policy from State Farm. This protection helps cover many home-related troubles. For example, what if a gas leak causes a fire or lightning strikes your unit? Despite the annoyance or emotional turmoil from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Darren Normoyle who can help you file a claim to help assist paying for your lost items. Preparing doesn’t stop troubles from crossing your path. Coverage from State Farm can help get your condo back to its sweet spot.

If you're ready to bundle or explore more about State Farm's excellent condo insurance, call or email agent Darren Normoyle today!

Have More Questions About Condo Unitowners Insurance?

Call Darren at (650) 257-7848 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

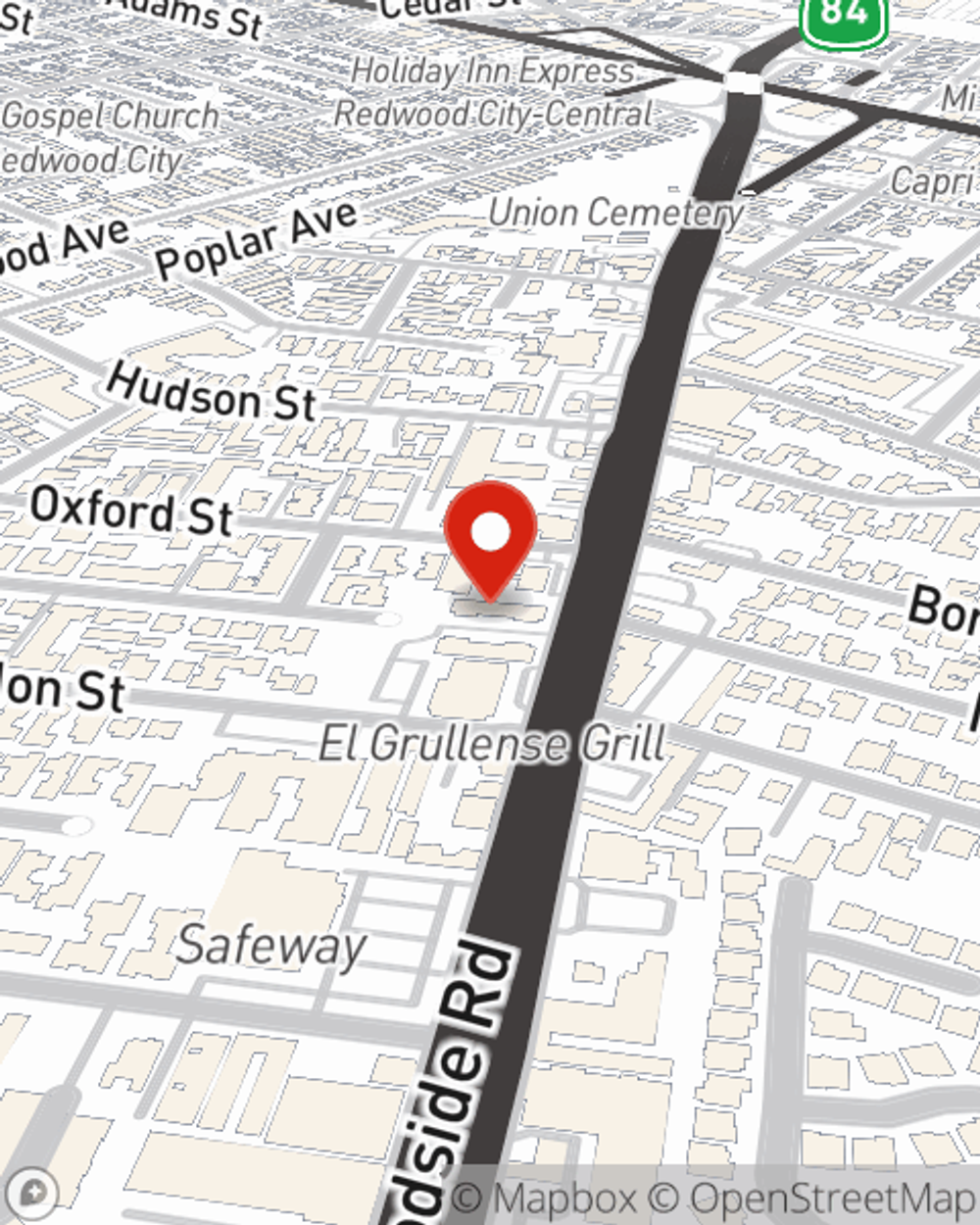

Darren Normoyle

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.